Thank you! You’re subscribed.

Oops! Something went wrong while submitting the form.

Get funding and payments insights, once a month.

Typical approval window for qualified funding requests.

Next-day funding options with eligible processing setups.

“Transparent rates, quick approvals, and the gear we needed to take payments anywhere. The switch paid for itself in weeks.”

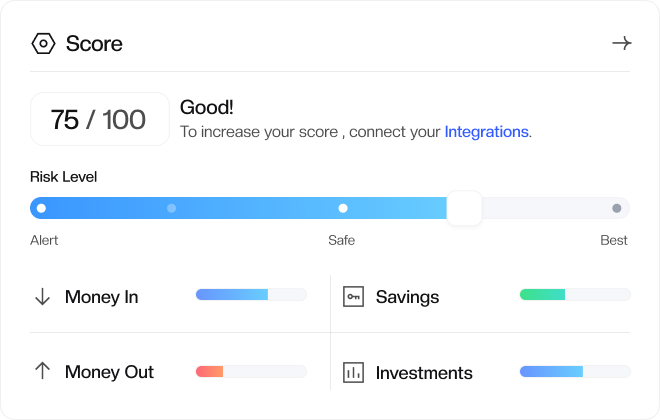

Cover inventory, payroll, equipment, or marketing. Fast approvals, clear terms, and flexible repayments designed around your cash flow.

Interchange-plus pricing with no junk fees. EMV, tap-to-pay, Apple/Google Pay, and e-com gateway support—simple setup, fast deposits.

Tools and guidance to prevent disputes and fight them when they happen—alerts, descriptors, documentation playbooks, and managed representment.

Countertop, wireless, and mobile readers—plus POS integrations and tap-to-pay on iPhone/Android.

Checkout links, invoice pay, recurring billing, and a modern gateway with tokenization.

Standard, same-day, or next-day funding options depending on processing setup and eligibility.

Whether you’re retail, restaurant, services, or online-first, FastPay fits the way you get paid.

Modern terminals, inventory-friendly funding, and next-day deposits to keep shelves stocked and lines moving.

Tip prompts, QR pay, handhelds for tableside, and cash-flow friendly funding for upgrades or expansion.

Invoice pay, subscriptions, and hosted checkout links. Use funding to hire, market, or add equipment.

No obligation and no hard credit pull to view offers. Get pre-approved and start saving on fees.