Thank you! You’re subscribed.

Oops! Something went wrong while submitting the form.

Get funding and payments insights, once a month.

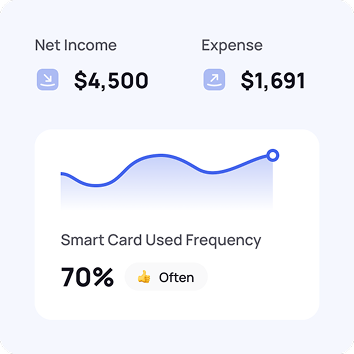

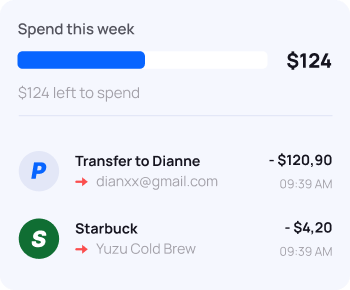

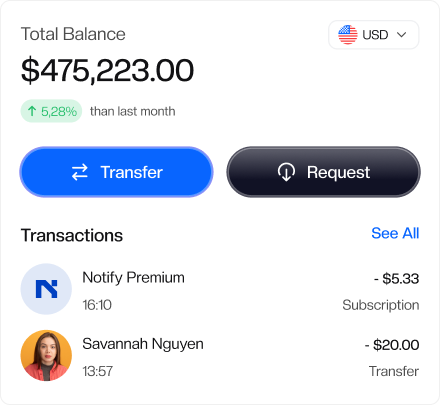

We help small businesses move faster—combine flexible working-capital loans with transparent, low-fee credit card processing. No long bank queues, no confusing terms, just real people and clear pricing.

Fast decisions, flexible terms, and clear repayments designed for cash-flow needs—not bank bureaucracy.

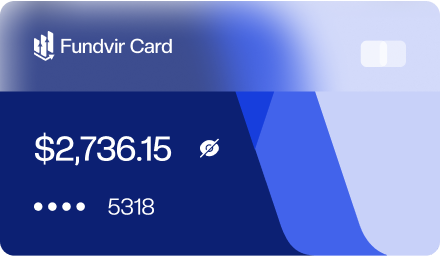

Transparent rates, next-day funding options, and modern terminals—no bait-and-switch, no long-term traps.

Countertop, mobile, and contactless options with easy setup and live support.

Hosted payment pages and invoice links so you can get paid from anywhere—securely.

Proactive alerts and dispute assistance to protect your revenue.

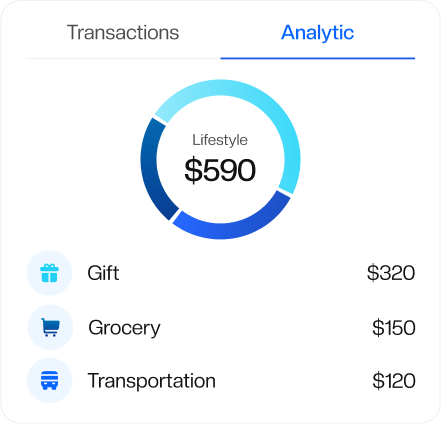

From food & beverage to retail and trades, FastPay tailors funding and payments to how you do business.

Upgrade terminals, accept tap-to-pay, and smooth out cash-flow with seasonal funding.

Take payments on-site or by invoice and bridge gaps between jobs with fast working capital.

Scale with online checkout links, recurring billing, and next-day funding options.

Quick decisions, honest pricing, and tools that make payments and cash-flow effortless.

No teaser rates. No junk fees. Just clear statements and predictable costs that scale with you.

Apply in minutes with minimal paperwork. Many approvals within 24–48 hours.

Talk to a human who understands small business. From setup to disputes, we’ve got you.

“Funding was quick and the processing fees are exactly what they promised. We upgraded our terminals and cash-flow in the same week.”

“Transparent rates and next-day funding saved us during our busy season. Support is fast and actually helpful.”

“We switched to FastPay for processing and stayed for the service. When we needed a short-term cash boost, they moved fast.”

“Straightforward, fair, and fast. That’s rare in payments—and exactly what we needed.”

Apply in minutes. Many decisions arrive within 24–48 hours. Funding timing depends on amount, documents, and bank speed.

We use transparent interchange-plus pricing. No long-term lock-ins, no junk fees. Get a custom quote based on your volume and card mix.

Most likely. We support retail, restaurants, trades, eCommerce, and more. Tell us how you operate and we’ll tailor the setup.

Often yes. We support a wide range of hardware and gateways, and we can recommend devices if you want to upgrade.

No. We believe in flexibility—pay down early if it helps your business.

Typically a government ID, recent bank statements, and basic business info. We’ll guide you step-by-step.

See your funding and processing options with no obligation and no hard credit pull.